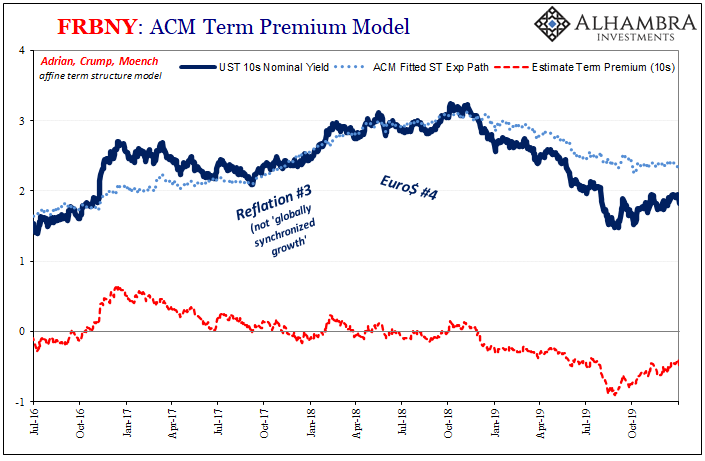

Nov 30, 2022In 1930, Fisher stated that “the money rate of interest (nominal rate) and still more the real rate are attacked more by the instability of money” than by demands for future income. In

miRcorrNet: machine learning-based integration of miRNA and mRNA expression profiles, combined with feature grouping and ranking [PeerJ]

Nov 2, 2022The Fisher Effect states that real interest rates are equal to nominal interest rates, minus the expected rate of inflation. It takes its name from Irving Fisher who was the first to observe the relationship. The Fisher Effect can be shown mathematically by the Fisher Equation: Nominal interest rates are the rates set by the central bank, as

Source Image: slideplayer.com

Download Image

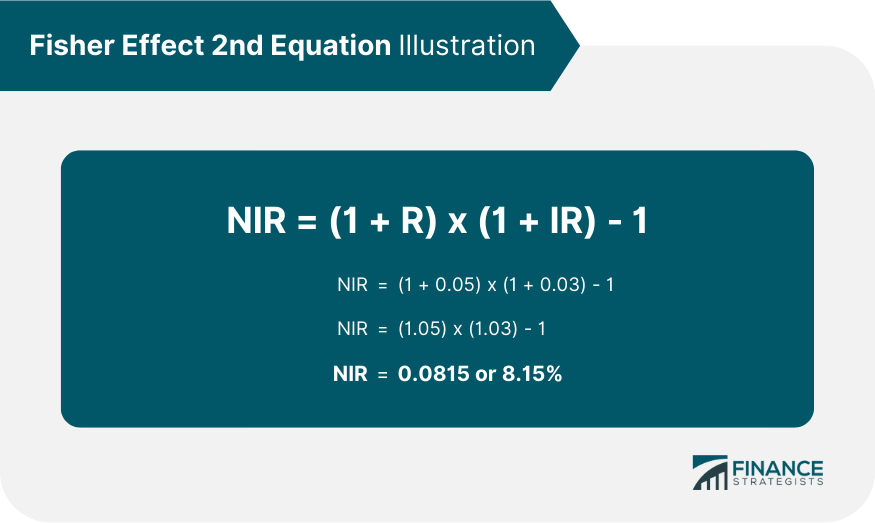

Jan 18, 2024The Fisher effect is defined as an economic theory that explains the relationship between the nominal interest rate and the real interest rate. Hence, to fully understand the Fisher effect equation, we need first to understand the nominal interest rate and the real interest rate.

Source Image: financestrategists.com

Download Image

Debre Markos University College of Business and Economics Department of Economics | PDF | Money | Index (Economics)

Whereas, monetary policy generally does not affect the real interest rate. American economist Irving Fisher proposed the equation. Fisher Equation Formula. The Fisher equation is expressed through the following formula: (1 + i) = (1 + r) (1 + π) Where: i – the nominal interest rate; r – the real interest rate; π – the inflation rate

Source Image: alhambrapartners.com

Download Image

The Fisher Effect Decomposes The Nominal Rate Into:

Whereas, monetary policy generally does not affect the real interest rate. American economist Irving Fisher proposed the equation. Fisher Equation Formula. The Fisher equation is expressed through the following formula: (1 + i) = (1 + r) (1 + π) Where: i – the nominal interest rate; r – the real interest rate; π – the inflation rate

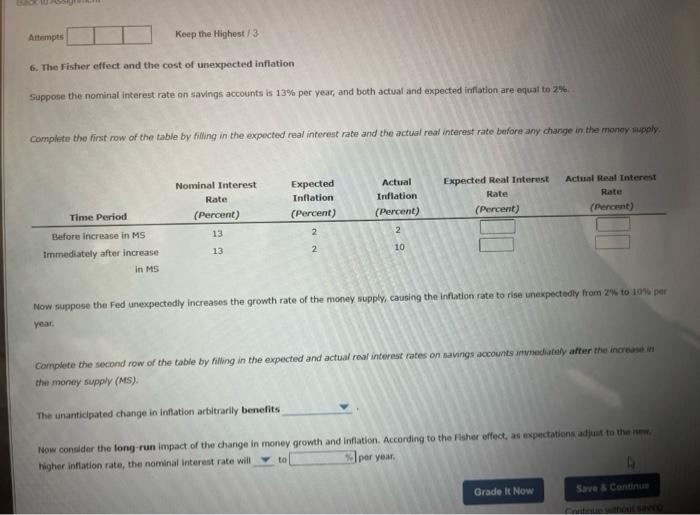

The Fisher effect states how, in response to a change in the money supply, changes in the inflation rate affect the nominal interest rate. The quantity theory of money states that, in the long run, changes in the money supply result in corresponding amounts of inflation. In addition, economists generally agree that changes in the money supply

Dressed Up Delusions of Bad Math: The False Term Premium Inflation Promise – Alhambra Investments

The quantity theory and the Fisher equation together tell us how ______ affects the ______. money growth, nominal interest rate. The one-for-one influence of expected inflation on the nominal interest rate. Fisher effect. According to the ______, an increase in the rate of money growth of 1 percent causes a 1 percent increase in the rate of

EBS1 FPFA00 SAPI SPMT 1021 D00 Piping and Valve Material Specification | PDF | Pipe (Fluid Conveyance) | Valve

Source Image: scribd.com

Download Image

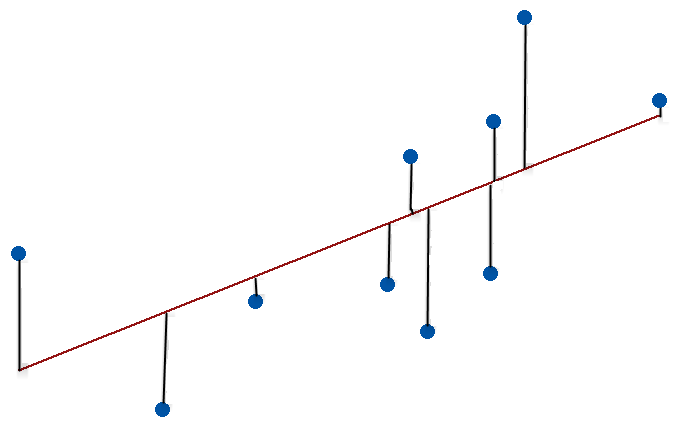

Choosing the Correct Type of Regression Analysis – Statistics By Jim

The quantity theory and the Fisher equation together tell us how ______ affects the ______. money growth, nominal interest rate. The one-for-one influence of expected inflation on the nominal interest rate. Fisher effect. According to the ______, an increase in the rate of money growth of 1 percent causes a 1 percent increase in the rate of

Source Image: statisticsbyjim.com

Download Image

miRcorrNet: machine learning-based integration of miRNA and mRNA expression profiles, combined with feature grouping and ranking [PeerJ]

Nov 30, 2022In 1930, Fisher stated that “the money rate of interest (nominal rate) and still more the real rate are attacked more by the instability of money” than by demands for future income. In

![miRcorrNet: machine learning-based integration of miRNA and mRNA expression profiles, combined with feature grouping and ranking [PeerJ]](https://dfzljdn9uc3pi.cloudfront.net/2021/11458/1/fig-3-full.png)

Source Image: peerj.com

Download Image

Debre Markos University College of Business and Economics Department of Economics | PDF | Money | Index (Economics)

Jan 18, 2024The Fisher effect is defined as an economic theory that explains the relationship between the nominal interest rate and the real interest rate. Hence, to fully understand the Fisher effect equation, we need first to understand the nominal interest rate and the real interest rate.

Source Image: scribd.com

Download Image

How the Fisher Effect Explains the Impact of Inflation on Interest Rates – FasterCapital

Feb 2, 2022The Fisher Effect demonstrates the connection between real interest rates, nominal interest rates, and the rate of inflation. According to the Fisher Effect, the real interest rate is equal to the nominal interest rate minus the expected rate of inflation (note that in this equation, all rates used should be compounded).

Source Image: fastercapital.com

Download Image

Solved 5. Using money creation to pay for government | Chegg.com

Whereas, monetary policy generally does not affect the real interest rate. American economist Irving Fisher proposed the equation. Fisher Equation Formula. The Fisher equation is expressed through the following formula: (1 + i) = (1 + r) (1 + π) Where: i – the nominal interest rate; r – the real interest rate; π – the inflation rate

Source Image: chegg.com

Download Image

What is Fisher Effect ( Definition, formula ) by finance n insurance – Issuu

The Fisher effect states how, in response to a change in the money supply, changes in the inflation rate affect the nominal interest rate. The quantity theory of money states that, in the long run, changes in the money supply result in corresponding amounts of inflation. In addition, economists generally agree that changes in the money supply

Source Image: issuu.com

Download Image

Choosing the Correct Type of Regression Analysis – Statistics By Jim

What is Fisher Effect ( Definition, formula ) by finance n insurance – Issuu

Nov 2, 2022The Fisher Effect states that real interest rates are equal to nominal interest rates, minus the expected rate of inflation. It takes its name from Irving Fisher who was the first to observe the relationship. The Fisher Effect can be shown mathematically by the Fisher Equation: Nominal interest rates are the rates set by the central bank, as

Debre Markos University College of Business and Economics Department of Economics | PDF | Money | Index (Economics) Solved 5. Using money creation to pay for government | Chegg.com

Feb 2, 2022The Fisher Effect demonstrates the connection between real interest rates, nominal interest rates, and the rate of inflation. According to the Fisher Effect, the real interest rate is equal to the nominal interest rate minus the expected rate of inflation (note that in this equation, all rates used should be compounded).